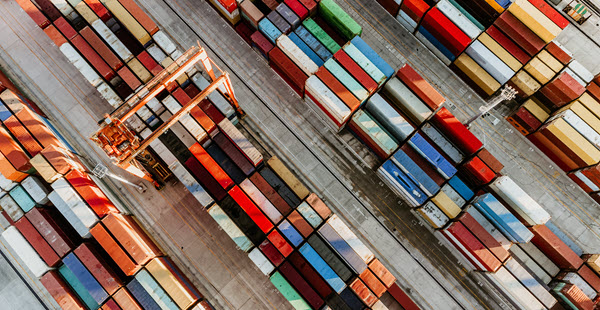

Sanctions, trade agreements, trade wars, ESG, tariffs and trade agreements are part of the everyday discussion around customs & international trade. This calls for coordinated tax and legal services, and increased trade regulation underscores the importance of implementing compliance plans to avoid stiff penalties. With markets in constant flux and tax laws rapidly evolving, companies need advisers who can provide local insight and global perspective on customs taxation issues everywhere they operate.

Our Global Customs team works with colleagues across borders and practice areas to advise multinational companies on customs and trade regulation, tax compliance, commercial agreements, trade-related enforcement actions, IP enforcement, consumer protection laws, the US Foreign Corrupt Practices Act and other anti-corruption laws.

Businesses must learn to evolve in an ever-changing legal and tax landscape during a very unstable political climate, while at the same time navigating an increasingly digitized working environment. This subject has evolved from one of compliance to playing a key role in a company's business strategy and value chain.

Our Core Customs & Trade Competencies

To help simplify complexity and avoid enforcement actions, our customs lawyers execute compliance plans, prepare WTO-consistent policies and business strategies, perform compliance audits, conduct compliance and ethics training, and guide clients through investigations and prosecutions.

We also represent clients in disputes brought before the Court of International Trade and other international fair trade bodies. We assist in resolving customs litigation, particularly with regard to clarification of and compliance with applicable tariffs and duties.