In brief

The UAE Federal Tax Authority (FTA) has released its first Advance Pricing Agreement (APA) Corporate Tax Guide (APA Guide) on 30 December 2025. This introduces a formal mechanism for businesses to obtain prospective certainty on transfer pricing (TP) for related-party transactions and to mitigate potential audit exposure.

The APA program is being launched in a phased manner. First, the FTA is launching the APA focusing only on Unilateral APAs (UAPAs). For domestic controlled transactions the FTA will accept applications for UAPAs from 30 December 2025, with cross-border UAPAs to be launched in 2026. While the scope of the APA program is limited as of now, obtaining an APA can provide taxpayers with certainty on the transfer pricing between freezone and mainland entities.

The FTA intends to expand to Bilateral (BAPA) and Multilateral APAs (MAPA) over time, although a specific timeline was not given by the FTA.

Groups with significant domestic transactions should consider whether a UAPA can reduce the TP risk, especially in case of complex domestic business models, with different tax rates and other incentives (e.g., in cases of transactions with QFZPs). The Baker McKenzie Tax and Transfer Pricing team has extensive experience with negotiating and concluding APAs in other jurisdictions across the globe, so please reach out to our specialists to discuss the opportunities for advance tax certainty in the UAE.

In more detail

1. Who can apply

Any Person entering into domestic and/or cross border transactions with Related Parties, provided the materiality threshold of AED 100 million per tax period is met for the Controlled Transactions which the taxpayer intends to include in the APA. APAs should only be considered for more complex business operations or controlled transactions as transactions under safe harbor rules, such as low value adding services, are excluded.

As of now, the FTA will only accept applications for domestic transactions. Domestic Controlled Transactions may be covered under an UAPA if the Person and its domestic Related Party are subject to different tax rates or are eligible for any tax incentives under the CT Law (e.g., transactions between UAE mainland and UAE free zone entities).

2. Scope and Coverage

An APA sets out the criteria for determining the arm's length price in relation to Controlled Transactions entered or to be entered into by that Person, over a fixed period of time. It includes, among others, the Controlled Transactions covered, the tax periods to be covered, the agreed TP criteria, critical assumptions and documentation and implementation mechanisms.

The applicable tax periods of the APAs range from three to five years. In Phase I, UAPAs only cover prospective periods. APAs are binding on the FTA and the taxpayer for the agreed period, provided conditions are met.

3. APA process

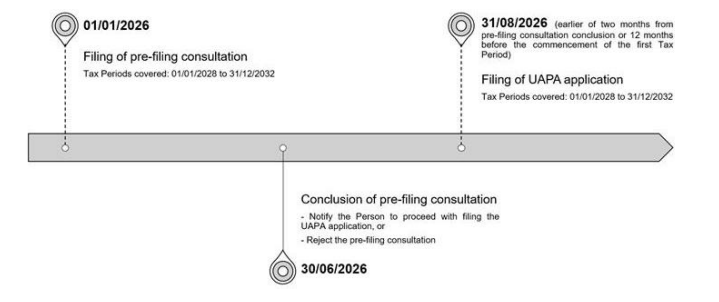

The APA process follows four stages including (1) pre-filing consultation, (2) APA application filing; (3) evaluation and negotiation and (4) conclusion and signing. The FTA provides timelines for each of these steps, including the follow chart for illustrative purposes:

Once the APA has been signed, an annual APA declaration needs to be submitted by the taxpayer. The FTA may revise, cancel or revoke an APA if critical assumptions change or are breached or the taxpayer fails to comply with APA terms.

4. APA fees

The application fee is AED 30,000, which is non-refundable. The renewal fee is AED 15,000.

5. Exchange of information

Cross-border UAPAs will be subject to spontaneous exchange of information, including with jurisdictions of the ultimate parent, immediate parent and related counterparties.

6. Benefit of concluding an APA to taxpayers

Transfer pricing inherently involves a degree of uncertainty, because it requires the application of judgment to qualitative factors and evolving market conditions. This subjectivity can create ambiguity around what constitutes an arm's length outcome, particularly in jurisdictions like the UAE where administrative practice is still developing. The APA framework provides a valuable opportunity for taxpayers to reduce this uncertainty by proactively defining and agreeing the transfer pricing methodology with the Federal Tax Authority. By engaging early and using the APA process to articulate and substantiate the TP policy, taxpayers can effectively control the narrative, obtain alignment with the FTA, and secure long term certainty over their intercompany pricing.

Our global Baker McKenzie Tax and Transfer Pricing team brings deep, proven experience in negotiating and finalizing APAs across numerous jurisdictions. Please contact one of the team members above.