In brief

The Thai Securities and Exchange Commission (SEC) has launched Public Hearing No. AorNorRor. 1/2569 on the draft green investment trust (GIT) regulations ("Public Hearing"), building on its earlier public hearing in 2024 on the governing principles for GIT.

The proposed draft establishes GIT as a fundraising vehicle, with investments primarily focused on environmental projects aimed at reducing or sequestering greenhouse gas emissions through forestry and agricultural activities, registered under the Thailand Voluntary Emission Reduction Program (T‑VER) or other recognized standards. According to the Public Hearing, the GIT must earn its income from the sale of carbon credits and certain timber harvesting activities, in accordance with the requirements prescribed by Thailand Greenhouse Gas Management Organization (TGO). The Public Hearing will end on 9 February 2026.

In more detail

This client alert highlights key characteristics and key principles under the proposed GIT regulations, summarized as follows:

Key characteristics and principles

Trust structure

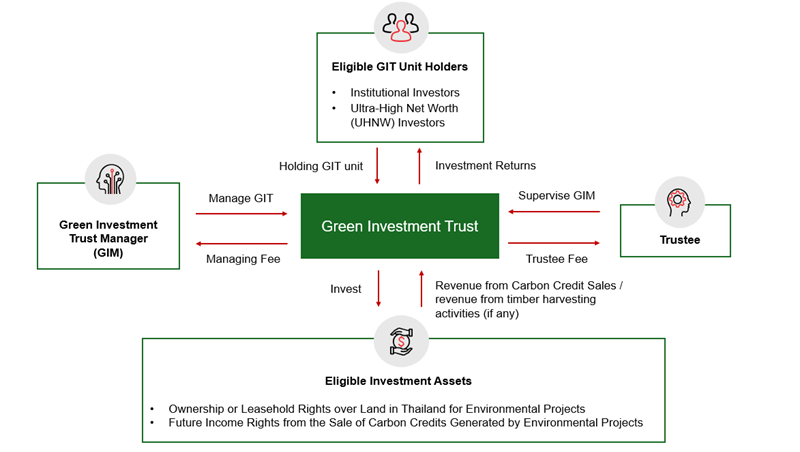

A GIT is structured with a trustee responsible for holding the trust assets, appointing and overseeing the green investment trust manager (GIM), and ensuring that the GIM manages the trust in accordance with the trust deed that is in compliance with the Trust for Transactions in Capital Market Act B.E. 2550 ("Trust Act"). In order to undertake these duties, the trustee must be licensed under the Trust Act. The trustee delegates the day‑to‑day business operations and management of the trust to the GIM, including the execution of contracts and the conduct of business activities on behalf of the trust. The settlor of the trust may be either the trustee or the GIM of the GIT.

Qualifications of the GIM

The GIM must be a legal entity established under Thai law, with the management of investment trusts as its core business. Where the GIM engages in other businesses, such businesses must be related to their role as a GIM and must not give rise to conflicts of interest or pose risks to the financial position or stability of the GIM, unless there are adequate measures to prevent conflicts of interest and manage risks.

The GIM must not concurrently manage more than one GIT investing in the same category of projects. The T-VER forestry projects include:

- Sustainable forestation

- Large-scale sustainable forestation

- Economic fast-growing tree plantations

- Reducing emissions from deforestation and forest degradation and enhancing carbon sequestration in forest area projects

The Public Hearing is silent on any SEC approval requirement for GIMs. The trustee is responsible for ensuring that the GIM possesses all qualifications prescribed under the law.

Authorization for offering GIT units

The offering of trust units is deemed approved by the SEC, provided that it complies with the prescribed regulatory requirements (i.e., a general approval regime rather than case‑by‑case approval) and that the draft trust deed and required documents are submitted to the SEC in accordance with the filing requirements.

Allocation of trust units and eligible investors

Under the proposed regulatory framework, trust units of a GIT may be offered only to: (i) institutional investors; and (ii) ultra-high-net-worth (UHNW) investors. The trust deed is required to include transfer restrictions to ensure that trust units may not be transferred to others who are not institutional investors or UHNW investors.

In addition, trust units may not be allocated to any person or group of related persons in an amount exceeding 50% of the total trust units sold. Furthermore, where the underlying assets (i.e., land) of the trust are subject to foreign ownership restrictions under applicable laws, any allocation of trust units to foreign investors must also comply with such restrictions.

Eligible investment assets

The principal assets of a GIT are limited to the following assets:

- Ownership or possessory rights over land located in Thailand that meet the eligibility criteria prescribed by the SEC, including the requirement that such land must not have proprietary encumbrances or disputes, unless an exemption applies.

- Future income rights from the sale of carbon credits generated by environmental projects.

The aggregate value of such principal assets must be at least 75% of the total value of the trust units offered.

Sources of returns

The primary source of returns must be derived from the sale of carbon credits generated from environmental projects that are registered under the T-VER or internationally recognized standards for greenhouse gas emission reduction or sequestration projects, as well as returns from timber harvesting activities (if any).

Borrowings and encumbrances

A GIT is allowed to borrow when needed, provided that such borrowings meet the criteria prescribed by the SEC and are clearly specified in the trust deed. These include, among others, that the borrowings must not resemble a perpetual bond or contain embedded derivatives, except where such features are expressly permitted.

Assets valuation

The eligible investment assets of the GIT (e.g., ownership over land and future income rights) must be reliably valued under accepted valuation standards and supported by an SEC‑approved valuer. An initial valuation of the eligible investment assets must be conducted within one year from the date on which the GIT invests in them. Thereafter, a full valuation must be carried out at least once every two years from the date of the most recent valuation. In addition, a review of the valuation must be conducted annually, counting from the date of the most recent full valuation.

Observations and regulatory considerations

Under the proposed GIT framework, the scope of eligible assets is relatively narrow, as investments are limited to: (1) ownership or possessory rights over real property; and (2) future income from the sale of carbon credits and returns from timber harvesting. This results in a constrained investment universe and ties GIT returns to carbon‑related assets and revenue streams. It is worth considering extending this to include rights of use or concession‑type rights over forest land, which could be used to develop and operate environmental projects. In addition, while it includes ownership or possessory rights over land, the framework does not clearly specify the extent to which such land can be utilized to generate income and subsequently distribute returns to investors.

Compared to other investment schemes already in place, the green tokens issued for environmental purposes provide a good basis for comparison with the GIT. When comparing the two schemes, the green token regulations appear to offer greater flexibility regarding eligible underlying assets and the use of proceeds for environmental projects. In particular, the rules broadly permit using offering proceeds to invest in environmental projects, without prescribing specific forms of underlying assets. From a fundraising perspective, this regulatory divergence may place GITs at a comparative disadvantage and could give rise to an uneven playing field between different investment structures pursuing similar environmental objectives.

Looking ahead

Thailand's regulatory framework for environmental project financing will continue to evolve alongside market practices and policy priorities. Market participants should monitor developments on the proposed GIT regime as environmental and sustainability focused projects may also benefit from government policies designed to promote green financing and encourage broader participation in this sector.

For more details, please contact our team at Baker McKenzie.

* * * * *

Phetrada Kampusiri, Senior Associate, and Yanisa Nilkhet, Associate have contributed to this legal update.