On 25 May 2018, the Council of the European Union (EU) adopted a directive on the mandatory disclosure and exchange of cross-border tax arrangements. This is the sixth update of the Directive on Administrative Cooperation, therefore referred to as 'DAC6' and the disclosure regime is now live.

Under the new rules, intermediaries such as lawyers, tax advisors, and accountants that design, promote or implement certain 'arrangements', or that provide advice in relation to such arrangements, are required to report them to tax authorities.

Key Takeaways

- These new rules on mandatory disclosure have implications both for us, as your intermediary, and for you, as our client.

- Although the policy objective is to address aggressive tax avoidance, the broad scope of definitions in the Directive means reportable arrangements may include arrangements that do not have a main benefit of obtaining a tax advantage.

- The reporting obligation lies with the EU intermediary, but shifts to the taxpayer in specific cases.

What is covered by mandatory disclosure under DAC6 (or 'the Directive')?

Intermediaries based in the EU or the UK will be obliged to submit information on reportable cross-border arrangements with their national tax authorities.

Under the Directive a 'reportable cross-border arrangement' refers to any cross-border (involving either two EU member states or one EU member state and a third state) tax planning arrangement which bears one or more of the hallmarks listed in the Directive and concerns at least one EU Member State.

The UK has committed to applying the reporting regime even after leaving the EU, but it is currently unclear how the interaction between the UK and the EU will be in this context, and therefore whether dual reporting can be avoided going forward.

Baker McKenzie is not making any assumption on any future interactions between the UK and the EU at this stage, but it is readying itself to respond and is proactively looking to minimize the impact to clients. For ease of description wherever the EU is referred to in the rest of the text, the UK is included.

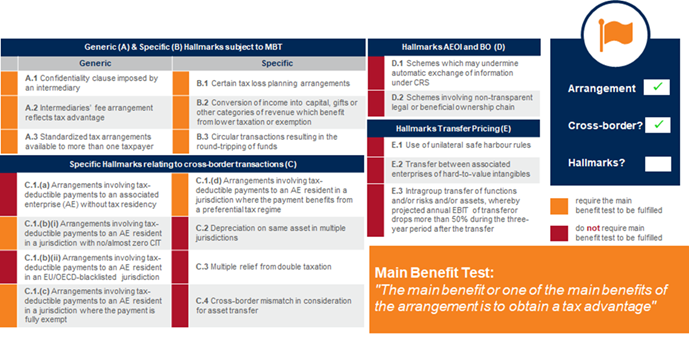

The hallmarks are broadly scoped and represent certain typical features of tax planning arrangements that, according to the Directive, potentially indicate tax avoidance or abuse of covered taxes (e.g., income taxes).

Certain arrangements (e.g., those that fall within the specific transfer pricing hallmarks) will need to be reported even if they do not satisfy the 'main benefit' (of obtaining a tax advantage) test. These include arrangements that involve hard-to-value intangibles or an intra-group cross-border transfer of functions, assets or risks.

Figure 1 - List of Hallmarks indicating which ones are used in combination with the main benefit test.

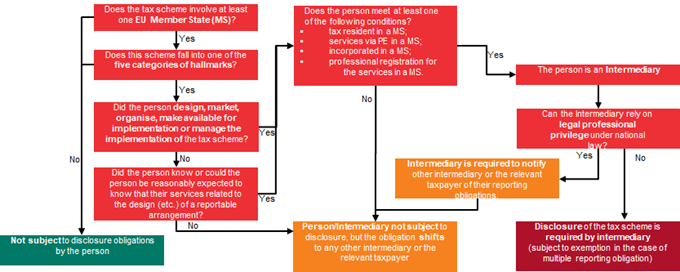

How is an 'Intermediary' defined?

Under the Directive an 'intermediary' refers to any person that designs, markets, organizes, makes available for implementation or manages the implementation of a reportable cross-border arrangement.

Additionally, it also means any person that, having regard to the relevant facts and circumstances and based on available information and the relevant expertise and understanding required to provide such services, knows, or could be reasonably expected to know, that they have undertaken to provide aid, assistance or advice with respect to a reportable cross-border arrangement.

In practice, intermediaries include lawyers, accountants, tax and financial advisors, banks and consultants. It can also include lawyers who are admitted in an EU jurisdiction but are working outside of the EU.

If the intermediary is not located in the EU or is bound by professional privilege or secrecy rules, the obligation to report shifts from the intermediary to the relevant taxpayer.

Information with regard to reported arrangements will be automatically exchanged by the competent authority of each EU Member State every three months through the use of a secure central directory on administrative cooperation in the field of direct taxation.

The information exchange will contain details such as the identification of intermediaries and relevant taxpayers, details on the relevant hallmarks and applicable domestic tax law provisions, details on the first step of implementation, details on the value of the reportable cross-border arrangement and identification of Member States that are affected or likely to be affected/concerned by the reportable arrangement.

Reporting Obligations Flowchart

Non-compliance (by intermediaries or taxpayers) with reporting requirements will attract penalties established by the national legislation of the respective EU Member State. The Directive prescribes that these penalties must be "effective, proportionate and dissuasive". The Directive also states that the fact that a tax authority does not react to a reportable cross-border arrangement does not imply any acceptance of the validity or tax treatment of that arrangement.

When do the new rules on Mandatory Disclosure begin to apply?

The new rules applied from 1 July 2020. However, the Directive has a retroactive component and the reporting obligation applies to transactions implemented between 25 June 2018 and 30 June 2020 (so-called "look-back period" or "first reporting period").

The initial intention was to report arrangements (the first step of which was) implemented in the 'lookback' period by 31 August 2020, and for any reportable arrangement designed or implemented since 1 July 2020 to be reported within 30 days from the relevant triggering event.

However, at the end of June 2020, the EU announced an optional delay to the reporting of six months. Most countries within the EU adopted the new time line, but three did not:

- Germany and Finland did not adopt any delay and therefore for Intermediaries in these countries the original timeline stands.

- Austria adopted an 'administrative' delay of three months. Therefore, the timeline here is to report arrangements implemented in the lookback period by 31 October 2020 and the 30-day reporting cycle for matters designed or implemented since 1 July 2020 starts on 1 October 2020

For all other EU jurisdictions: Intermediaries and relevant taxpayers are obliged to file information for the first time by 28 February 2021 with respect to reportable transactions implemented in the 'look-back period' (i.e., between 25 June 2018 and 30 June 2020). This means that records of any potentially reportable arrangements that have occurred from 25 June 2018 onwards should be kept. The 30-day reporting cycle for arrangements designed or implemented since 1 July 2020 starts on 1 January 2021. Subsequently, the first 'regular' information exchange between EU Member States will have to take place by 30 April 2021.

Timeline

What does mandatory disclosure under DAC6 mean for you as our client?

When you instruct an intermediary in the EU in an engagement that involves a 'reportable cross-border arrangement', that intermediary will in principle be required to report the arrangement to its national tax authority.

If the intermediary is legally qualified and professional privilege applies (which was determined by each the Member States separately so different rules apply in different jurisdictions), or if you instruct only an intermediary situated outside of the EU, the reporting obligation will shift to you and you will be responsible for complying with the reporting obligations.

The important point to understand is that if you are involved in a reportable cross-border arrangement then a report will need to be filed under the mandatory disclosure regime by either an intermediary or relevant taxpayer. Instructing an EU intermediary does not create a reporting obligation.

What does mandatory disclosure under DAC6 mean for us, Baker McKenzie as your intermediary?

When you instruct Baker McKenzie in an engagement that involves a 'reportable cross-border arrangement', we will comply with our reporting obligations. If professional privilege applies (as described above), we will inform you of the obligation to report the arrangement.

When you engage multiple intermediaries, the reporting obligation lies with all intermediaries involved in the same arrangement, however an intermediary can be exempt from reporting to the extent that it has proof that an adequate and complete report of the arrangement has been filed by another intermediary.

Whenever we are an intermediary under the terms of the regulation, we will assess each individual arrangement and inform you on our or your (potential) reporting obligations. Each time we will outline the scope of the relevant reporting obligations to you and, where applicable, support you in complying with your reporting obligations.

If you have any questions

This description of DAC6 is by necessity short and by no means covers all the issues. In addition, guidance and practice of DAC6 is changing as tax authorities refine their thinking and indeed in some cases finalize their legislation. We are closely monitoring the implementation of the rules and development of guidance.